Rafe wrote: Thu Oct 13, 2022 12:06 pmAnd not that I'm a big Saudi royal family or even OPEC supporter, but the media coverage over the OPEC announcement has been...just...well, ignorant. And Brandon wants to threaten the Saudis with a decades-old arms sales agreement over it? Come on, man!philip964 wrote: Thu Oct 13, 2022 9:35 am Saudi Arabia confirms White House begged them to delay OPEC deal until after the midterms.

https://www.dailymail.co.uk/news/articl ... -deal.html

Wanted Saudi Arabia to influence US election.

All the writing on the wall--worldwide--is that we're either on the precipice of a global recession or we're already stepping over the brink. The OPEC countries get the vast majority of their income from what? Oil. Simple economics: what drives the price and profitability of your commodity down? An overbalance of supply versus demand. As the march toward recession increases, people start spending less, and demand decreases.

Brandon's squandering, since he took office, of 26% of our nation's Strategic Petroleum Reserve (we're at its lowest level since 1984; pray we don't have an actual emergency need for it, because he can't replenish it any time soon without a massive amount of more spending) didn't really move prices at the pump down; reduced demand did. Trucks gotta roll and ships gotta sail, but consumers reduced their amounts of non-essential travel. Couple that with China's vastly reduced demand due to continuing, intermittent COVID lockdowns, and you have the likelihood of a worldwide lessening of demand.

Specifically, what OPEC did was not increase prices or immediately cut production. What they did do was cutback the estimated oil demand forecast for 2023. In doing so, OPEC said that it sees a risk to demand for crude from a resurgence of COVID-19 cases in China, high global inflation, and significant economic trouble in Europe.

Say you have a business that manufactures widgets. You're reading the tea leaves and it sure looks to you like the global economy is inching into the proverbial handbasket. Demand for widgets still exists, and will continue to exist, but marketplace prices, due to lessening demand, have gone down 10% in recent weeks. If a full-blown global recession hits, demand for widgets is going to bottom out. After he publicly calls you and your company a pariah, a senile man comes to you, hat in hand, begging that you do nothing to position yourself for the recession. In fact, he asks that you increase widget production in order to help him out by effectively driving down the cost of widgets. But if you want your company to weather the recession as well as possible, what you need to be doing is concentrating on net revenues and banking cash, not lowering margins by manufacturing widgets at a faster pace. Sitting on warehouses full of widgets that are selling for lower prices than they could be due to lessened market demand is not a winning plan to batten the hatches for a recession.

It's called free market capitalism. RBC Capital Markets said yesterday that oil prices could tumble by 40% next year "if a deep recession leads to demand destruction." You'd be trying to do everything you could to protect your widget business if it looked like the selling price could drop 40%, and there likewise should be no expectation that OPEC would, out of sheer altruism and sympathy for a demented man who can't construct sentences or find his way off a stage, potentially harm its own partner nations' economies in order to help mitigate the numerous failures of the Biden administration. This White House has failed at every single turn, and it will reap what it sows. The country's only hope is that the dems lose both the House and Senate on November 8.

Biden having his puppet strings pulled by Green New Deal extremists got us into this situation, not OPEC. Three years ago the U.S. was energy independent. Not only that, we were able to be a major exporter of oil and gas while securely keeping the home fires burning, as it were, without being beholden to any other nation. This whole mess started its dumpster dive precisely on January 20, 2021.

BTW, the U.S. Strategic Petroleum Reserve currently sits at about 450 million barrels, and Biden announced the release of 10 million more barrels to market in November. Just before the midterm elections, naturally. We were already a bit below the SRP authorized storage capacity of 714 million barrels. So to bring us back up to normal emergency storage capacity, we would need to buy 274 million barrels of oil. We meaning us, the U.S. taxpayers. Currently, oil (Brent) sits at $94.10 a barrel. Gasoline refinement aside, that means that, right now, it would cost us taxpayers over $25.78 billion just to replace what will have been drawn down by November 8.

Former President Joe Biden- library may be book mobile

Moderators: carlson1, Charles L. Cotton

Re: Joe Xiden AKA Brandon

-

Grayling813

- Senior Member

- Posts: 2655

- Joined: Mon Jun 24, 2019 11:18 am

Re: Joe Xiden AKA Brandon

In the 2020 Stimulus bill the Demoncrats killed a request by President Trump to spend $2.3 billion dollars to purchase 77 million barrels of oil to refill the Strategic Reserves at a cost of approximately $29/barrel. So now to replenish the Strategic Reserves is going to cost a great deal more with oil hovering around $90/barrel.Rafe wrote: Thu Oct 13, 2022 12:06 pmAnd not that I'm a big Saudi royal family or even OPEC supporter, but the media coverage over the OPEC announcement has been...just...well, ignorant. And Brandon wants to threaten the Saudis with a decades-old arms sales agreement over it? Come on, man!philip964 wrote: Thu Oct 13, 2022 9:35 am Saudi Arabia confirms White House begged them to delay OPEC deal until after the midterms.

https://www.dailymail.co.uk/news/articl ... -deal.html

Wanted Saudi Arabia to influence US election.

All the writing on the wall--worldwide--is that we're either on the precipice of a global recession or we're already stepping over the brink. The OPEC countries get the vast majority of their income from what? Oil. Simple economics: what drives the price and profitability of your commodity down? An overbalance of supply versus demand. As the march toward recession increases, people start spending less, and demand decreases.

Brandon's squandering, since he took office, of 26% of our nation's Strategic Petroleum Reserve (we're at its lowest level since 1984; pray we don't have an actual emergency need for it, because he can't replenish it any time soon without a massive amount of more spending) didn't really move prices at the pump down; reduced demand did. Trucks gotta roll and ships gotta sail, but consumers reduced their amounts of non-essential travel. Couple that with China's vastly reduced demand due to continuing, intermittent COVID lockdowns, and you have the likelihood of a worldwide lessening of demand.

Specifically, what OPEC did was not increase prices or immediately cut production. What they did do was cutback the estimated oil demand forecast for 2023. In doing so, OPEC said that it sees a risk to demand for crude from a resurgence of COVID-19 cases in China, high global inflation, and significant economic trouble in Europe.

Say you have a business that manufactures widgets. You're reading the tea leaves and it sure looks to you like the global economy is inching into the proverbial handbasket. Demand for widgets still exists, and will continue to exist, but marketplace prices, due to lessening demand, have gone down 10% in recent weeks. If a full-blown global recession hits, demand for widgets is going to bottom out. After he publicly calls you and your company a pariah, a senile man comes to you, hat in hand, begging that you do nothing to position yourself for the recession. In fact, he asks that you increase widget production in order to help him out by effectively driving down the cost of widgets. But if you want your company to weather the recession as well as possible, what you need to be doing is concentrating on net revenues and banking cash, not lowering margins by manufacturing widgets at a faster pace. Sitting on warehouses full of widgets that are selling for lower prices than they could be due to lessened market demand is not a winning plan to batten the hatches for a recession.

It's called free market capitalism. RBC Capital Markets said yesterday that oil prices could tumble by 40% next year "if a deep recession leads to demand destruction." You'd be trying to do everything you could to protect your widget business if it looked like the selling price could drop 40%, and there likewise should be no expectation that OPEC would, out of sheer altruism and sympathy for a demented man who can't construct sentences or find his way off a stage, potentially harm its own partner nations' economies in order to help mitigate the numerous failures of the Biden administration. This White House has failed at every single turn, and it will reap what it sows. The country's only hope is that the dems lose both the House and Senate on November 8.

Biden having his puppet strings pulled by Green New Deal extremists got us into this situation, not OPEC. Three years ago the U.S. was energy independent. Not only that, we were able to be a major exporter of oil and gas while securely keeping the home fires burning, as it were, without being beholden to any other nation. This whole mess started its dumpster dive precisely on January 20, 2021.

BTW, the U.S. Strategic Petroleum Reserve currently sits at about 450 million barrels, and Biden announced the release of 10 million more barrels to market in November. Just before the midterm elections, naturally. We were already a bit below the SRP authorized storage capacity of 714 million barrels. So to bring us back up to normal emergency storage capacity, we would need to buy 274 million barrels of oil. We meaning us, the U.S. taxpayers. Currently, oil (Brent) sits at $94.10 a barrel. Gasoline refinement aside, that means that, right now, it would cost us taxpayers over $25.78 billion just to replace what will have been drawn down by November 8.

- 03Lightningrocks

- Senior Member

- Posts: 11460

- Joined: Tue Apr 08, 2008 5:15 pm

- Location: Plano

Re: Joe Xiden AKA Brandon

Rafe wrote: Thu Oct 13, 2022 12:06 pmAnd not that I'm a big Saudi royal family or even OPEC supporter, but the media coverage over the OPEC announcement has been...just...well, ignorant. And Brandon wants to threaten the Saudis with a decades-old arms sales agreement over it? Come on, man!philip964 wrote: Thu Oct 13, 2022 9:35 am Saudi Arabia confirms White House begged them to delay OPEC deal until after the midterms.

https://www.dailymail.co.uk/news/articl ... -deal.html

Wanted Saudi Arabia to influence US election.

All the writing on the wall--worldwide--is that we're either on the precipice of a global recession or we're already stepping over the brink. The OPEC countries get the vast majority of their income from what? Oil. Simple economics: what drives the price and profitability of your commodity down? An overbalance of supply versus demand. As the march toward recession increases, people start spending less, and demand decreases.

Brandon's squandering, since he took office, of 26% of our nation's Strategic Petroleum Reserve (we're at its lowest level since 1984; pray we don't have an actual emergency need for it, because he can't replenish it any time soon without a massive amount of more spending) didn't really move prices at the pump down; reduced demand did. Trucks gotta roll and ships gotta sail, but consumers reduced their amounts of non-essential travel. Couple that with China's vastly reduced demand due to continuing, intermittent COVID lockdowns, and you have the likelihood of a worldwide lessening of demand.

Specifically, what OPEC did was not increase prices or immediately cut production. What they did do was cutback the estimated oil demand forecast for 2023. In doing so, OPEC said that it sees a risk to demand for crude from a resurgence of COVID-19 cases in China, high global inflation, and significant economic trouble in Europe.

Say you have a business that manufactures widgets. You're reading the tea leaves and it sure looks to you like the global economy is inching into the proverbial handbasket. Demand for widgets still exists, and will continue to exist, but marketplace prices, due to lessening demand, have gone down 10% in recent weeks. If a full-blown global recession hits, demand for widgets is going to bottom out. After he publicly calls you and your company a pariah, a senile man comes to you, hat in hand, begging that you do nothing to position yourself for the recession. In fact, he asks that you increase widget production in order to help him out by effectively driving down the cost of widgets. But if you want your company to weather the recession as well as possible, what you need to be doing is concentrating on net revenues and banking cash, not lowering margins by manufacturing widgets at a faster pace. Sitting on warehouses full of widgets that are selling for lower prices than they could be due to lessened market demand is not a winning plan to batten the hatches for a recession.

It's called free market capitalism. RBC Capital Markets said yesterday that oil prices could tumble by 40% next year "if a deep recession leads to demand destruction." You'd be trying to do everything you could to protect your widget business if it looked like the selling price could drop 40%, and there likewise should be no expectation that OPEC would, out of sheer altruism and sympathy for a demented man who can't construct sentences or find his way off a stage, potentially harm its own partner nations' economies in order to help mitigate the numerous failures of the Biden administration. This White House has failed at every single turn, and it will reap what it sows. The country's only hope is that the dems lose both the House and Senate on November 8.

Biden having his puppet strings pulled by Green New Deal extremists got us into this situation, not OPEC. Three years ago the U.S. was energy independent. Not only that, we were able to be a major exporter of oil and gas while securely keeping the home fires burning, as it were, without being beholden to any other nation. This whole mess started its dumpster dive precisely on January 20, 2021.

BTW, the U.S. Strategic Petroleum Reserve currently sits at about 450 million barrels, and Biden announced the release of 10 million more barrels to market in November. Just before the midterm elections, naturally. We were already a bit below the SRP authorized storage capacity of 714 million barrels. So to bring us back up to normal emergency storage capacity, we would need to buy 274 million barrels of oil. We meaning us, the U.S. taxpayers. Currently, oil (Brent) sits at $94.10 a barrel. Gasoline refinement aside, that means that, right now, it would cost us taxpayers over $25.78 billion just to replace what will have been drawn down by November 8.

NRA-Endowment Member

http://www.planoair.com

http://www.planoairconditioningandheating.com

http://www.planoair.com

http://www.planoairconditioningandheating.com

-

powerboatr

- Senior Member

- Posts: 2276

- Joined: Mon Mar 23, 2009 9:53 pm

- Location: North East Texas

Re: Joe Xiden AKA Brandon

agree with all the above

AND no body in congress is even talking about getting our oil from TX, OK,AK, or anywhere stateside under trump we as the USA were the domiant global energy super power, we exported more than we used domestically, we exported more refine product to anywhere in the world than any country

we refined imported products and sent them back out MORE than any other country.

we had the saudis and opec under control

I pray nov goes good and the repubs pull their heads out of the sand and play BALL by real rules and take no prisoners in the bull form brandon

just blame the opec+ and saudis/...

isnt strange

AND no body in congress is even talking about getting our oil from TX, OK,AK, or anywhere stateside under trump we as the USA were the domiant global energy super power, we exported more than we used domestically, we exported more refine product to anywhere in the world than any country

we refined imported products and sent them back out MORE than any other country.

we had the saudis and opec under control

I pray nov goes good and the repubs pull their heads out of the sand and play BALL by real rules and take no prisoners in the bull form brandon

just blame the opec+ and saudis/...

isnt strange

Proud to have served for over 22 Years in the U.S. Navy Certificated FAA A&P technician since 1996

Re: Joe Xiden AKA Brandon

Yep. That 77 million barrels was the total amount Trump drew down the reserves. Shock. He's a businessman. He understands business accounting and budgeting. He wanted to replenish the SPR as soon as feasible, top it back off at 714 million barrels. Not only did the dems kill that, but by election day they'll have drawn it down an additional 383 million barrels. And now it's over three times more expensive than it was in 2020.Grayling813 wrote: Thu Oct 13, 2022 3:11 pm

In the 2020 Stimulus bill the Demoncrats killed a request by President Trump to spend $2.3 billion dollars to purchase 77 million barrels of oil to refill the Strategic Reserves at a cost of approximately $29/barrel. So now to replenish the Strategic Reserves is going to cost a great deal more with oil hovering around $90/barrel.

I can't remember a president--certainly not one in my lifetime--that has been so completely unwilling to take responsibility for something going wrong wrong as does the Biden administration. I honestly can't think of one single thing they've done right, from the day-one war on the U.S. energy industry to the disastrous Afghanistan abandonment to bizarre cabinet appointments to inflation to the wide-open border and fentanyl epidemic...you name it. Nothing, not one single thing, has this administration had the...integrity (I was about to use a word that wouldn't be appropriate on this forum) to own.

Listen to any head football coach at even tier 2 colleges. They know they're the leader. They step up and take responsibility when they lose. And they spread the credit around to the other coaches and the players when they win. Not rocket surgery. It's the way to handle it, and it's the honorable thing to do; it inspires with honesty.

But the Biden administration doesn't even have the leadership experience and honor of a coach at a small college. Instead of honesty and integrity, the default response is to either outright lie or to cast blame everywhere else, like a rotating lawn sprinkler trying to hit everything around it.

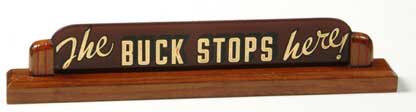

Somebody needs to request from the Truman Presidential Library the sign that Harry kept on his desk, then force Biden to put it on his desk:

“Be ready; now is the beginning of happenings.”

― Robert E. Howard, Swords of Shahrazar

― Robert E. Howard, Swords of Shahrazar

Re: Joe Xiden AKA Brandon

Rafe wrote: Thu Oct 13, 2022 7:59 pm ...............I honestly can't think of one single thing they've done right, from the day-one war on the U.S. energy industry to the disastrous Afghanistan abandonment to bizarre cabinet appointments to inflation to the wide-open border and fentanyl epidemic...you name it. Nothing, not one single thing, has this administration had the...integrity (I was about to use a word that wouldn't be appropriate on this forum) to own............

Your list could have also included Russia and their complete failure to stop the war before it began. It would have never happened under Trump.

Greg Gutfeld recently had a video montage of Brandon lost on stage. We really do not have a President at the moment. We have a chief of staff, a wife and some hangerons being the puppet master. It is really very sad.

I really hope 5 billion people don't die because of it.

-

Grayling813

- Senior Member

- Posts: 2655

- Joined: Mon Jun 24, 2019 11:18 am

Re: Joe Xiden AKA Brandon

Biden 'not competent' to be president after appearing to zone out during MSNBC interview: Rep. Claudia Tenney

https://www.foxnews.com/media/biden-not ... dia-tenney

Zoned out during interview.

There is a point Kamala can still have two terms, that will be the point he resigns. That would be I guess after Jan 20 th 2023.

https://www.foxnews.com/media/biden-not ... dia-tenney

Zoned out during interview.

There is a point Kamala can still have two terms, that will be the point he resigns. That would be I guess after Jan 20 th 2023.

Re: Joe Xiden AKA Brandon

https://www.dailymail.co.uk/news/articl ... laims.html

Brandon committed six white collar crimes while VP.

So says careful review of Hunters laptop by right wing group.

Guide for new Congress.

Brandon committed six white collar crimes while VP.

So says careful review of Hunters laptop by right wing group.

Guide for new Congress.

Re: Joe Xiden AKA Brandon

https://www.breitbart.com/politics/2022 ... ets-round/

Brandon wants to limit gun owners to "eight bullets in a round".

Brandon wants to limit gun owners to "eight bullets in a round".

-

wheelgun1958

- Senior Member

- Posts: 1159

- Joined: Tue Mar 06, 2007 10:40 pm

- Location: Flo, TX

Re: Joe Xiden AKA Brandon

MIRV ammo!philip964 wrote: Mon Oct 24, 2022 5:46 pm https://www.breitbart.com/politics/2022 ... ets-round/

Brandon wants to limit gun owners to "eight bullets in a round".

- anygunanywhere

- Senior Member

- Posts: 7879

- Joined: Fri Apr 01, 2005 9:16 am

- Location: Richmond, Texas

Re: Joe Xiden AKA Brandon

Isn't that called buckshot??wheelgun1958 wrote: Mon Oct 24, 2022 6:33 pmMIRV ammo!philip964 wrote: Mon Oct 24, 2022 5:46 pm https://www.breitbart.com/politics/2022 ... ets-round/

Brandon wants to limit gun owners to "eight bullets in a round".

"When democracy turns to tyranny, the armed citizen still gets to vote." Mike Vanderboegh

"The Smallest Minority on earth is the individual. Those who deny individual rights cannot claim to be defenders of minorities." – Ayn Rand

"The Smallest Minority on earth is the individual. Those who deny individual rights cannot claim to be defenders of minorities." – Ayn Rand

-

srothstein

- Senior Member

- Posts: 5337

- Joined: Sat Dec 16, 2006 8:27 pm

- Location: Luling, TX

Re: Joe Xiden AKA Brandon

Have to use 000 buckshot. Twelve gauge 00 buckshot is 9 pellets per round.anygunanywhere wrote: Mon Oct 24, 2022 8:22 pmIsn't that called buckshot??wheelgun1958 wrote: Mon Oct 24, 2022 6:33 pmMIRV ammo!philip964 wrote: Mon Oct 24, 2022 5:46 pm https://www.breitbart.com/politics/2022 ... ets-round/

Brandon wants to limit gun owners to "eight bullets in a round".

Steve Rothstein

Re: Joe Xiden AKA Brandon

If the legacy media had any decency they would demand this sick old man resign and get the long term medical care he needs.philip964 wrote: Mon Oct 24, 2022 5:46 pm https://www.breitbart.com/politics/2022 ... ets-round/

Brandon wants to limit gun owners to "eight bullets in a round".

JOIN NRA TODAY!, NRA Benefactor Life, TSRA Defender Life, Gun Owners of America Life, SAF, VCDL Member

LTC/SSC Instructor, NRA Certified Instructor, CRSO

The last hope of human liberty in this world rests on us. -Thomas Jefferson

LTC/SSC Instructor, NRA Certified Instructor, CRSO

The last hope of human liberty in this world rests on us. -Thomas Jefferson

-

Grayling813

- Senior Member

- Posts: 2655

- Joined: Mon Jun 24, 2019 11:18 am

Re: Joe Xiden AKA Brandon

They can't until the time passes that would allow Cackles two full terms in addition to riding out Bidet's. So look for 25th Amendment action after Jan 20, 2023.Paladin wrote: Tue Oct 25, 2022 6:51 amIf the legacy media had any decency they would demand this sick old man resign and get the long term medical care he needs.philip964 wrote: Mon Oct 24, 2022 5:46 pm https://www.breitbart.com/politics/2022 ... ets-round/

Brandon wants to limit gun owners to "eight bullets in a round".